Wunderlich December Realtor Report

This December “Realtor Report” is provided by Gene Wunderlich, director of government affairs for the Southwest Riverside County Association of Realtors. For space reasons, some of the comments and charts in the Realtor Report do not appear here. Direct questions to GeneWunderlich@srcar.org.

It’s a Wrap!

By Gene Wunderlich

SRCAR VP of Government Affairs

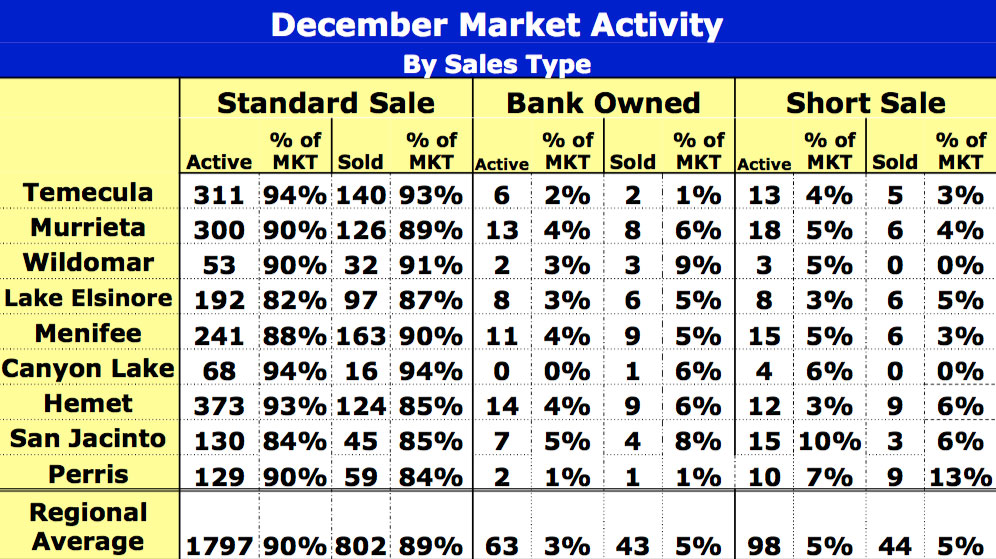

To paraphrase Charles Dickens, it wasn’t the best of times, it wasn’t the worst of times – 2015 ended just in time, not with a bang, but a whimper. As forecast, December sales volumes for the region spiked up 24 percent over November, pulling the year up 9 percent over 2014 ( 9,932/10,916) and a scant 1 percent ahead of 2013 (10,764). Median price also bumped up for the region by 1 percent, moving the needle enough to finish the year 6 percent ahead of 2014 ($300,111/$319,103).

Revenue from single family real estate transactions contributed a hefty $3.5 billion dollars to local revenue streams in 2015, a 15 percent increase over the $2.9 billion in 2014. 560 condominium sales added another $116 million.

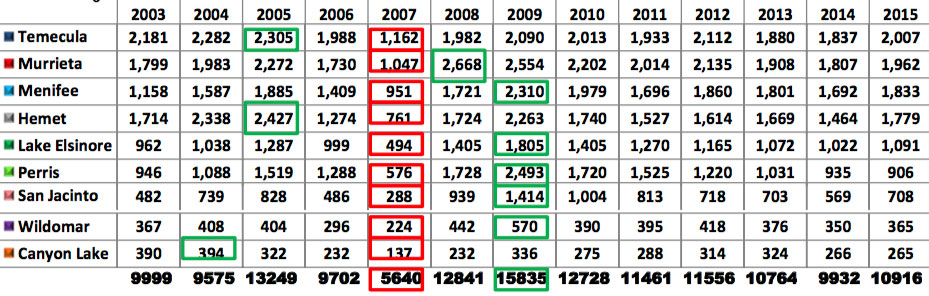

Graphs and charts attached to this report break it all down, with an interesting look back at our local market for the past 13 years. We’ve clawed our way back pretty well from the sales bust of 2007 when we only sold 5,640 homes. As a region, we’ve still got a ways to go to catch our best ever year in 2009 when 15,835 homes sold.

Our regional median price has also recovered nearly 37 percent from our 2009 trough ($201,264/$319,103), though still nearly 30 percent off our 2006 peak ($448,894). Some cities have fared better than others with Temecula pulling within 17 percent of its peak price ($449,651/$543,545).

So now we’ve got another year behind us, what’s next for 2016? Well, as some of the attached prognostications surmise, we’re in for more of the same: slow, steady growth. Maybe a little slower than 2015.

UC Riverside’s Chris Thornberg claims “the roller coaster ride is over. . . there will be no big surprises in 2016. We’re nowhere near the top of the cycle. This market has a ways to go.” CoreLogic Chief Economist Dr. Frank Nothaft says “. . . home price growth remains in its sweet spot.” NAR’s Dr. Lawrence Yun is also on board with increases in the 5 to 6 percent range for 2016, with sales climbing back to pre-recession levels.

We’ll know in the next 90 days if these positive vibes actually play out against a less certain backdrop.

At the national level, with manufacturing off significantly last quarter, will the U.S. continue to add jobs at a rate that inspires consumer confidence and support home buyers? And will that finally be reflected in a GDP closer to 3 percent than 2 percent? The Fed is expected to continue ratcheting up rates for the next 12 to 18 months, assuming everything doesn’t grind to a halt in the meanwhile.

At some point that will start impacting mortgage rates. Health care costs have already jumped, offset to some degree by falling gas prices. And what of the economists who caution that we are entering the seventh year of our economic recovery cycle, which tend to cycle every six to eight years?

Internationally, what happens if the Middle East continues to conflagrate and gas prices jump? What happens if the EU disintegrates, or Europe’s economy continues to falter under the onslaught of refugees and China’s economy tanks?

Closer to home, we are dealing with a shrinking housing inventory, declining affordability and a political climate that is discouraging home building. A recent study conducted by Chapman University’s Center for Demographics and Policy pointed out a number of concerns about our housing market.

California’s rate of issuing building permits per 1,000 residents is 2.2. Los Angeles issues just 1.7 permits per 1,000 and the Inland Empire comes in at 2.3. Contrast this to the Dallas-Fort Worth area where the average was 6.3 permits and the number of permits issued was roughly double the number for Los Angeles-Orange County, which boasts nearly three times the population.

As I’ve cautioned before, our housing shortage in California is reaching crisis levels. Regulatory, environmental and infrastructure issues restrict our ability to build, and limit the affordability of the products we do build – even in our area.

As Joel Kotkin, an R.C. Hobbs Presidential Fellow in Urban Studies at Chapman University recently pointed out, “Progressive housing policy – so beloved by our political leaders – turns out to be very regressive, indeed.” Assuming that Millennial buyers enter the housing market at some point, even if it’s just multi-family housing, the demand for a rare commodity will skyrocket, affordability will be further reduced and we enter another cycle of housing bust even before we fully enjoyed a boom.

Oh well, our housing market was better in 2015 than 2014, prices have been appreciating in a moderately sustainable fashion for four years, the recovery, though anemic, appears to be continuing and we’re getting some rain. No use worrying about things we have no control over – just try to make the best of it and have a happy New Year!

Southwest County Sales

It’s been an interesting ride for our regional housing market over the past dozen years. While a few cities enjoyed peak sales years prior to the 2007 bust, most hit their mark afterwards. Those who peaked earlier had the best of both worlds because their peak hit at a time when prices were also high.

Those hitting their peak sales years subsequent to 2007 weren’t quite as lucky because a 2009 sales peak coincided with a 2009 price trough.

But while everybody experienced their sales peaks at different times, every city hit bottom at the same time in 2007. Over the next two years, sales doubled or tripled in most cases until all the distressed inventory had been swallowed up by first-time buyers and investors. Prices started back up and sales moderated, spending much of the past five years fluctuating within a 5 percent range. If current growth estimates are accurate, 2016 sales volume will return to 2011-2012 levels.

The only safe forecast is that predicated in pending sales, January 2016 volume is going to suuuuck.

On a similar note, most of our region tanked price-wise in 2009. From its peak in 2006 our region lost nearly two-thirds of homeowner equity in just two years. Some of you remember the market in free-fall with prices dropping 2 to 3 percent a month and brown lawns sprouting up throughout the region.

And while prices have recovered to a greater or lesser degree, some of our communities have not benefitted and continue to struggle with reduced revenue and the aftermath of criminal activity brought on by the blight of distressed homes.

The upside, if it can be looked at that way, is that we still do have quite a ways to go before we hit those peak pricing levels again. Some cities will reach it faster than others; but if our current trajectory continues, our region will be back to 2006 levels within three to five years, some sooner. From a peak of 60-plus percent of homeowners being underwater, we’re down to about 20 percent, which will allow more people the luxury of being able to move if they want to.

We’re also into the third year of waiting for that pent-up demand caused by Millennials entering the market and “boomerang buyers,” those folks who lost their homes in 2007-2009 and are now able to purchase again. National studies indicate that as many as 70 percent of these people want to become homeowners again and, as rents continue to rise, will be forced into that decision sooner rather than later.

Previous Article

Library will be closed Monday for holiday