Wunderlich Realtor Report for July

This July “Realtor Report” is provided by Gene Wunderlich, vice-president of government affairs for the Southwest Riverside County Association of Realtors. For space reasons, some of the comments and charts in the Realtor Report do not appear here. Direct questions to GeneWunderlich@srcar.org.

Uncertainty

“Uncertainty may be a part of our lives and our business for many years to come. As Americans we are accustomed to quick fixes, but this may not be possible right now.” That was the message conveyed to us on Day 1 of the recent Inman Connect conference in San Francisco.

For 20 years, Brad Inman has been hosting an annual conference bringing together the best and brightest from the tech world and real estate focusing on the impact of technology in our lives. As usual, this year featured many media immersed 20-somethings capable of raising $125 million for a single idea that could be bust by this time next year, or sold to Google for $1 billion. Interesting crowd.

But the theme of uncertainty is one that my readers have been familiar with for some time. Uncertainty has dogged this entire “recovery” cycle with the housing market being both stronger than it should and weaker than it should, often at the same time.

Just when it looks like we’re out of the woods, we go off the rails for no apparent reason. Just when you think we’re heading south, prices and sales spike up. Why? Uncertainty. Just ask the Fed.

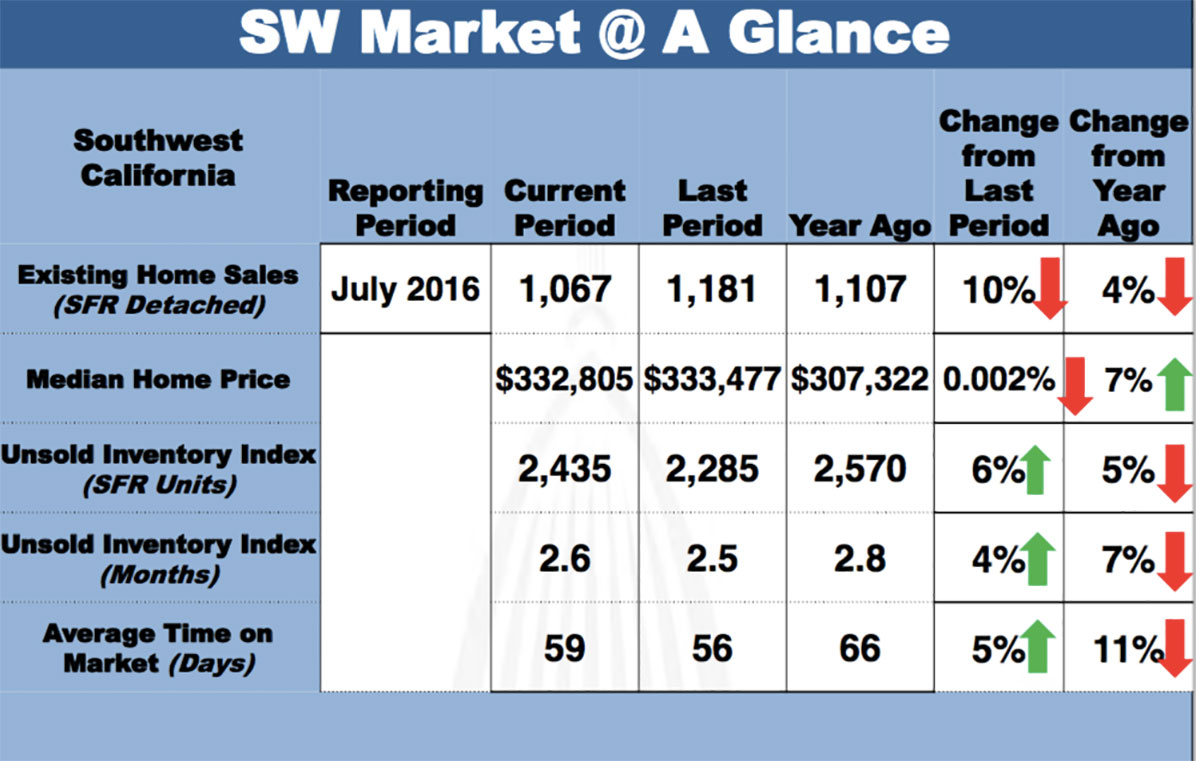

Uncertainty hit our market again in July – a month that is historically strong but for some reason took a dive last month. Despite a national resurgence in July housing numbers, sales in our region were off a full 10 percent month-over-month (1,067 / 1,181) and down 4 percent from last July (1,067 / 1,107).

That’s not supposed to happen until September when the summer selling season is over! Why did it appear to hit prematurely this year? Uncertainty! And the vagaries of the market. Interest rates remain at near record lows, inventory ticked up a little giving buyers a few more choices, lenders are rumored to be loosening their requirements a bit, yet down we went.

Pending sales, that precursor of what lies ahead, is telling us August will be about the same as July. I sincerely hope so because last year August sales fell nearly 20 percent month-over-month, sliding through the end of the year.

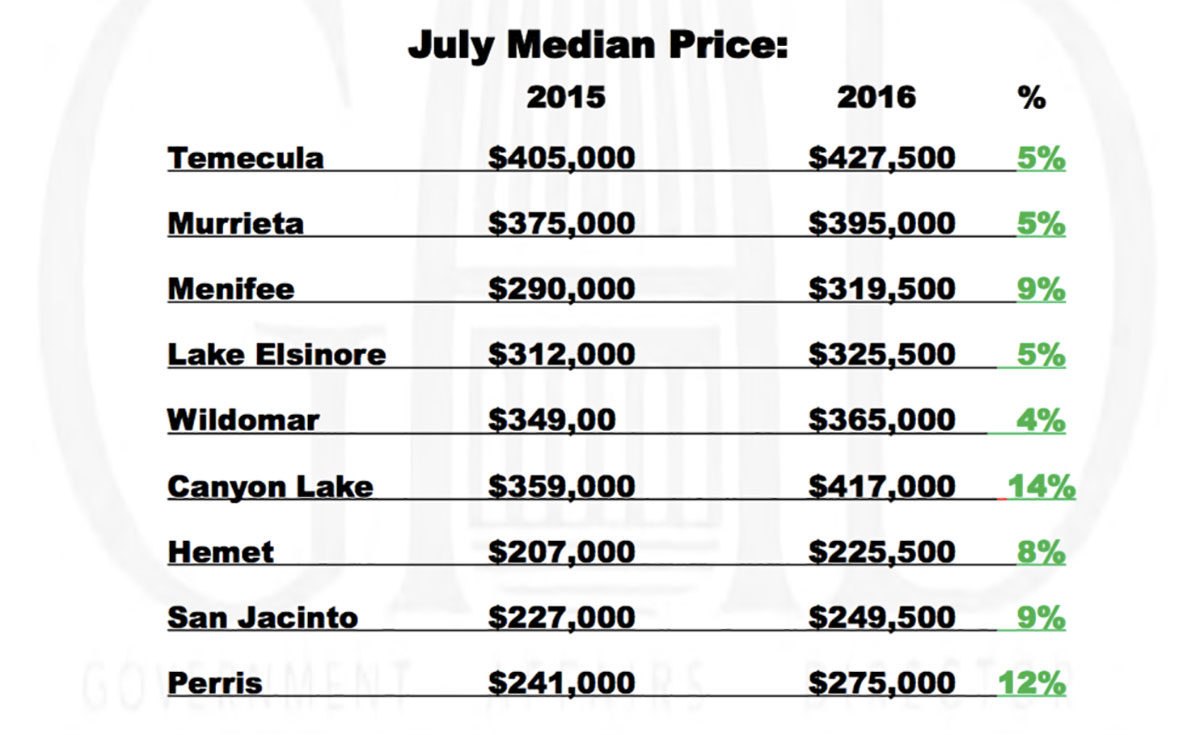

Prices managed to hold even for the month with most cities posting very small increases or decreases leading to a month over month drop of 0.002 percent ($333,471 / $332,805). Overall our regional median price holds a 7 percent lead over July 2015 ($307,322 / $332,805). That’s not bad and slightly higher than the state average increase of 5.5 percent.

With the decline in sales volume, absorption tapered off a bit allowing inventory to edge up slightly (2,285 / 2,435) providing a 2.6 month cushion, up from 2.5 months in June.

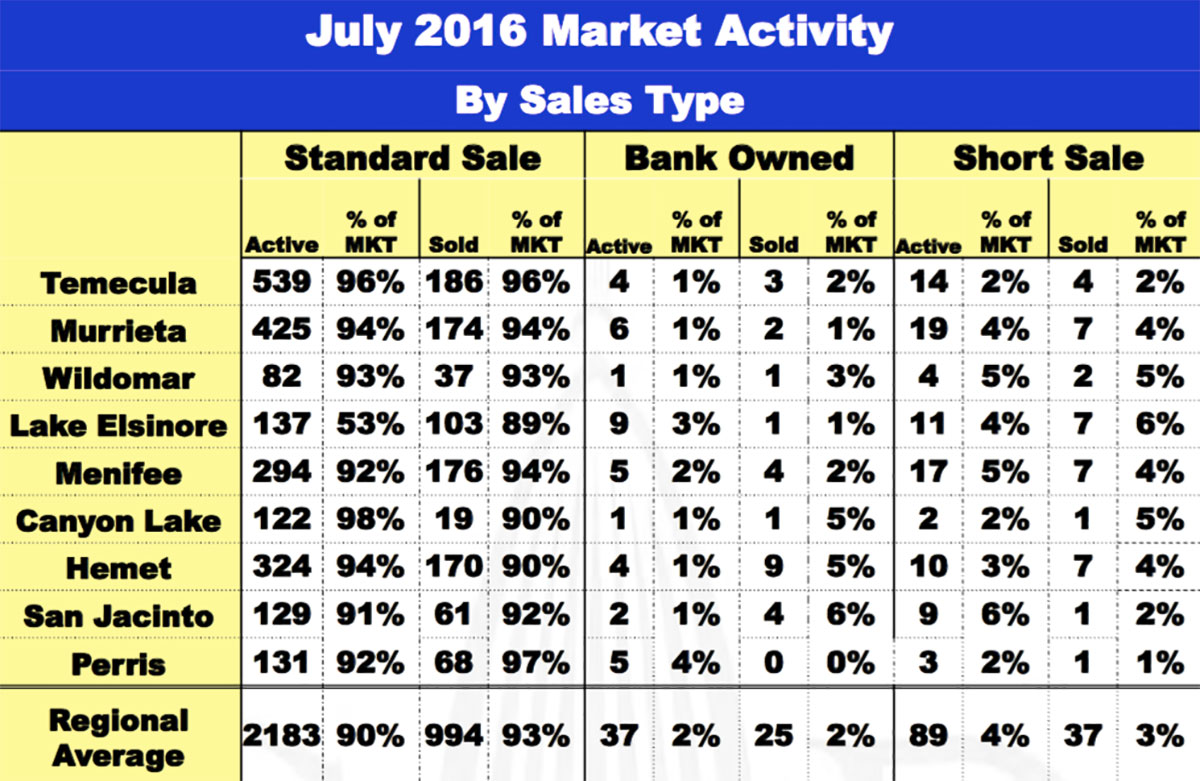

Properties also stayed on the market three days longer (56 / 59). Rumors abound that there’s an increase in foreclosure activity by lenders but you wouldn’t know it looking at our market. Sales of distressed properties, including bank-owned and short-sales, dropped to pre-recession levels in July at just 5 percent of sold homes.

As a percentage of standard sales on the market, 97 percent of Perris sales are “normal” sales, 96 percent in Temecula, and 94 percent in Murrieta and Menifee. Even during the best of times there’s about a 4 percent slice of the market in foreclosure; so for the time being it looks like our market is back to “normal.” That only took seven years!

No doubt uncertainty will continue to plague our housing market at least through the November election, at which time it will either get better, get worse, or stay the same.

Of that, I’m certain.

Previous Article

IRS warns of surge in automated phone scams

April 19, 2024

April 19, 2024